Business Intelligence In Banking – Dive into the world of Business Intelligence to better understand how BI components, processes, skills and tools come together to generate better insights.

This introductory business intelligence course provides an overview of business intelligence. The course begins with an overview of the elements of artificial intelligence and its differences with data science before covering the key components and processes. You will learn about each role in detail and what skills are needed in each position. As you progress through the course, you’ll understand how these functions work together to deliver actionable insights, along with examples of BI tools and how they can help transform your operations.

Business Intelligence In Banking

This course will also use visual methods in business intelligence to convey key messages to decision makers, as well as best practices in planning. Finally, we will discuss the different types of data, structures and images commonly used in Business Intelligence.

How Artificial Intelligence Is Influencing The Banking Sector

This introductory BI course is perfect for professionals who work with data and want to learn more about business intelligence. This course covers basic concepts in the field and is a stepping stone to more serious Business Intelligence topics.

Common career paths for students taking the BIDA™ program are Business Intelligence, Asset Management, Data Analytics, Quantitative Analysis, and other financial careers.

This introduction to Business Intelligence is part of CFI’s upcoming Business Intelligence & Data Analyst (BIDA)™ program. This program will cover all basic, intermediate and advanced topics related to business intelligence and data analytics. The program also includes a number of case studies to allow students to practice their skills and work on sample data. This program will teach you quantitative methods in financial markets and the capital industry. It is intended for students who want to learn how to analyze complex data. The program is completely online, so you can take it yourself, from anywhere in the world.

The Potential Of Ai In Banking

Students can sign up to receive updates and reserve a spot in the Business Intelligence & Data Analyst (BIDA) program on the Student Dashboard.

Chapter Introduction Free Overview What is Business Intelligence Free Overview BI Roles and Processes Free Overview The Data Analyst The Data Analyst – Common Tools Introduction to Power Query Introduction to Power Pivot Introduction to SQL Data Analyst – Summary Exercise Interactive 1 Data Visualization Specialist Data Visualization Specialist – Common Tools Introduction to Tableau Introduction to the Power of BI Interactive Exercise 2 The Business Leader Data Engineering Types of Data Storage Data Warehouse Data Engineer – Tools Summary of functions Interactive exercise 3 Area of interest Survey

Chapter Introduction Data Story Visuals, Dashboards and Charts Types of Focus Work Good and Bad Visuals Design Principles Visual Inspiration Interactive Exercise 4

Pdf) Digital Banking Transformation: Application Of Artificial Intelligence And Big Data Analytics For Leveraging Customer Experience In The Indonesia Banking Sector

Chapter Introduction Data types Manipulating data with Boolean functions Values and operators Comparing data structures Tables Joining data tables Types A data model Types of relationships Interactive exercise 5

Business Intelligence & Data Analyst (BIDA) courses are offered 100% online, allowing you to start the Business Intelligence & Data Analyst (BIDA)™ program anytime and learn when it’s most convenient for you.

Students must take all core and elective courses (17 in total) and demonstrate mastery of the subject areas by completing course materials, quizzes, and assessments.

How To De Bias Artificial Intelligence In Banking

It’s been an incredible journey with CFI in this race and I hope to learn a lot from it.

All of our certification programs are open to students and professionals in a variety of industries and experience levels. Our curriculum is designed to teach you what you need to know, from the basics to advanced practical studies. To carry out the lessons and exercises, students will only have access to a PC and/or Mac, Microsoft Suite (2016 or more recent) and a stable connection. Click here to see technical requirements

Absolutely! All the documents and samples necessary for their development are available for processing. See the module that displays downloadable files in the dashboard. See here for a visual guide on how to do this.

Solution: Business Intellilgence In Banking

You will have one year of access to the courses as long as you maintain an active subscription. All classes are self-paced so you can take your time learning without worrying about downtime. Click here to see our available email options.

Yes, CFI is accredited by the Better Business Bureau® (BBB) to maintain educational standards, CPA institutions in Canada and the National Association of State Boards of Accountancy (NASBA) in the United States. Most of our CPE accredited courses are referred to as CPE for CPA degrees. Please refer to this page to see all available CPE credits.

Person! The package price includes everything and there are no additional fees or charges to get your digital certification. You can see our address list here.

![]()

Adoption Of Business Intelligence & Analytics In Organizations

All of our online courses are billed in USD. As the most common form of payment, we accept all major credit and debit cards including Visa, MasterCard and American Express.

Students must complete all readings, quizzes, and final assessments for each year. You can retake the tests as many times as needed until you reach a passing grade of 80%. For more information on earning a Career Certificate, click HERE.

Students must complete an online assessment (multiple-choice, fill-in-the-blank and Excel questions) at the end of each course. You can take tests according to your schedule and you will have to pass at least 80% of the course and obtain your certificate of completion. Please note that the course tests can be repeated as often as necessary. Students must also pass the final FMVA® exam to obtain their certification. How to accept the second assessment

Business Intelligence Solutions For End To End Payments

Although the courses are primarily designed for self-study, we are happy to provide online help for general inquiries or technical support. Total Immersion packages include a premium email support service that allows you to communicate directly with in-house experts on career content. This is one of the main features that sets the Total Immersion package apart and makes the upgrade price from the studio package more affordable. You can find more information about our files here.

Based on hundreds of reviews from thousands of students, we know how CFI courses have helped so many people advance their careers in finance. Our courses are designed to be highly practical and simulate the experience of working as a professional financial analyst…the best way to advance your career. For real-life examples and even more in-depth career ideas, please check out our library of free career resources.

You can view more detailed information via our Help Center or email us, and we’ll be happy to answer any questions you have.

Ai In Banking

Financial Modeling & Valuation Analyst (FMVA)® Learn more Commercial Banking & Credit Analyst (CBCA)™ Learn more Capital Markets & Securities Analyst (CMSA)® Learn more Certified Business Intelligence & Data Analyst (BIDA)™ Learn more Financial Planning & Wealth Management (FPWM)® Learn more

Financial Modeling Guidelines CFI’s free Financial Modeling Guidelines are a detailed and comprehensive resource covering model design, model building blocks, tips, tricks and…

SQL Data Types What are SQL Data Types? Structured Query Language (SQL) contains various data types which allow it to store different types of data.

Neobanking Market Analysis, Size And Trends Global Forecast To 2022 2030

Structured Query Language (SQL) What is Structured Query Language (SQL)? Structured Query Language (SQL) is a special programming language designed to interact with databases. But in this article, we’re going to take a close look at what banking intelligence dashboards can do for your operations.

Next, we’ll highlight the three main uses and types of dashboards for retail banks. And we’ll dig deeper into the details you can use for your banking dashboard.

A banking business intelligence dashboard is an analytical display tool that is linked to different banking data across multiple systems. These systems include, but are not limited to: central banking platforms, CRMs, loan processing software, and any other type of banking data cell.

Top Business Intelligence (bi) Software 2022

Banking dashboards are used to track and visually display trusted KPIs (these are key performance indicators; more on that in a minute). Business process managers also track events, customer trends, financial performance… pretty much anything you want to track, as long as you’re prepared to analyze the data. Bank executive dashboards help you review historical trends, for example, loans or customer traffic. They can also, to some extent, see into the future, thanks to predictive analytics.

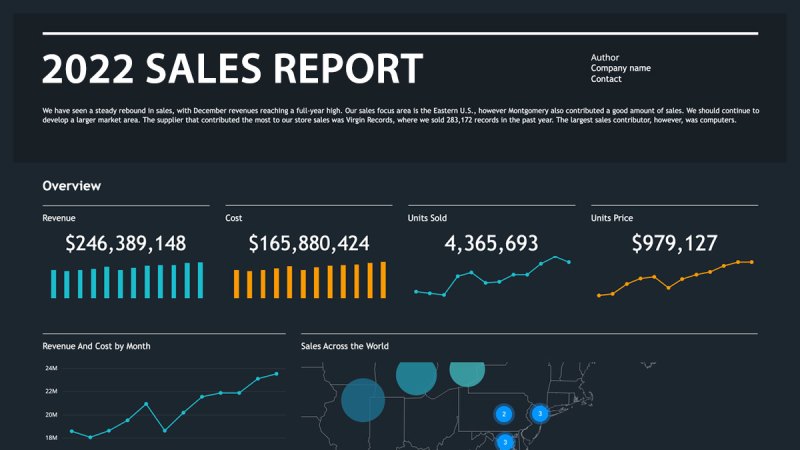

A recently completed “cleaned up” executive level banking dashboard for a client using Power BI can be seen below.

Banking dashboards do not create themselves. The amount of work involved in achieving accurate and precise collisions consists of two areas: 1) KPI selection and 2) data preparation. Believe it or not, it doesn’t matter what technique you use to show it. Power BI, Tableau, Qlik… they’re all the same after all. Data structure and KPIs are that kind of thing

Imal: Powering Islamic Banking Infrastructure

Business intelligence in banking pdf, artificial intelligence in banking and finance, business intelligence in banking sector, business intelligence banking, examples of artificial intelligence in banking, artificial intelligence in banking, artificial intelligence in banking case study, banking intelligence, business intelligence in banking industry, business intelligence in banking ppt, future of artificial intelligence in banking, application of artificial intelligence in banking